Court documents listed the persons involved by initials only, though whether those initials represent their real initials is unknown.

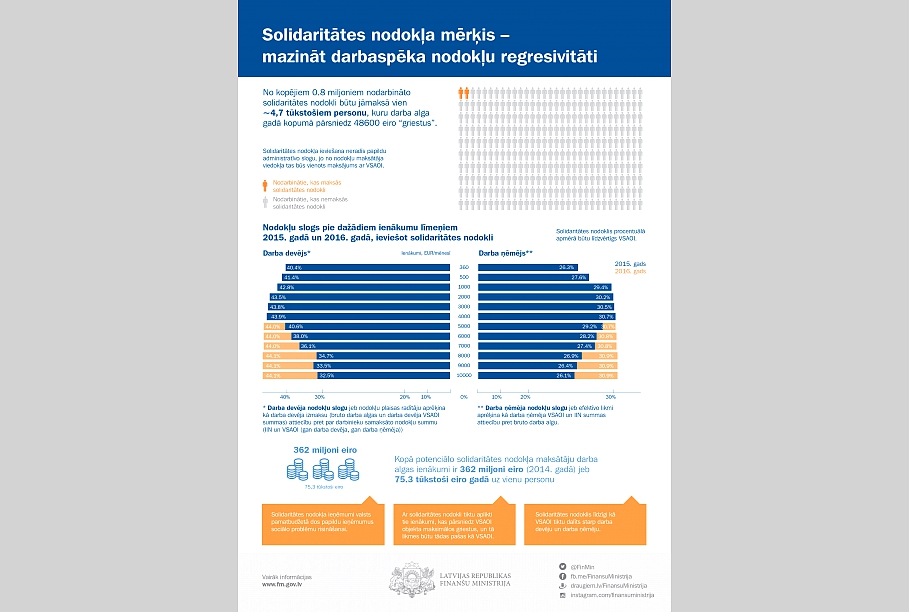

Some of the country's leading business people in both private and state-run companies are well known opponents of the so-called 'solidarity tax' which affects only the top 0.5% of wage-earners - around 4,700 people earning more than €48,600 euros per year.

After passing the €4,000 per month ceiling, income is taxed at a rate of 34%.

Solidarity tax was introduced in the 2016 budget by the Finance Ministry in an attempt to tackle "regressivity" in Latvia's flat tax system - meaning that essentially lower earners pay proportionally more of their income in tax than high earners.

It is expected to earn around €40m for government coffers this year but has predictably proved unpopular among some of those expected to pay it..

Latvia's average gross monthly wage in 2015 was €818.

The legal minimum monthly wage is €370.

The high-rolling plaintiffs (whoever they are) argue that the solidarity tax is unconstitutional as it discriminates against them as a group and will make it hard for their businesses (whichever they are) to compete in the jobs market for highly skilled professionals.

On Friday the court ruled that several of the plaintiffs' complaints had enough substance to justify a future case and the coutrt questioned several aspects of the law, giving the national parliament until September 21 to respond to its concerns before a test case begins, most likely in December.

As renowned local journalist Juris Kaza pointed out, the judges of the Constitutional Court themselves earn enough to put them in the top tax bracket...

Looks like Latvian Constitutional Court judges earn above the range where tax disputed before them kicks in. Conflict of interest issue?

— juriskazha (@juriskazha) July 22, 2016

...however it seems unlikely any judges are among the plaintiffs, whatever their initials.